Miami is a dynamic hub for business, attracting entrepreneurs from all over due to its strategic location, multicultural environment, and economic opportunities.

However, navigating the maze of licensing and bookkeeping regulations is essential for ensuring your business stays compliant and thrives.

We offer bookkeeping services in Miami and we want to help you understand and manage the regulatory landscape in Miami.

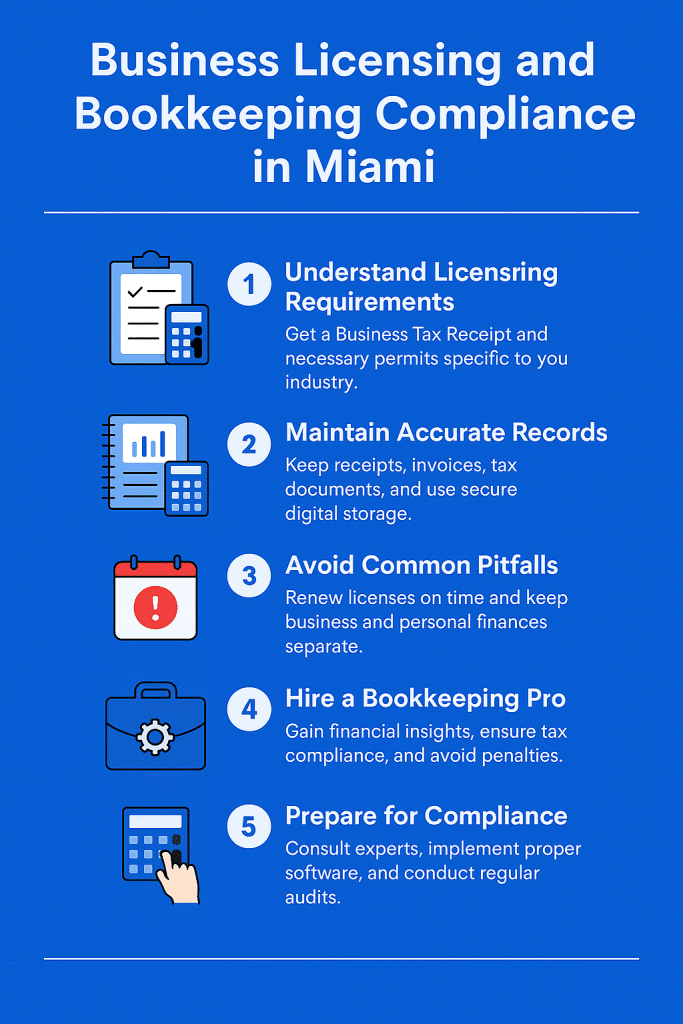

1. Understanding Business Licensing Requirements

Before opening your doors in Miami, it’s crucial to have the proper licenses and permits. Miami-Dade County, along with state and federal regulations, mandates specific documentation based on your business type and location.

Key steps include:

-

Registering your business with Sunbiz Florida and obtaining an EIN from the IRS

-

Business Tax Receipt (BTR): Required by Miami-Dade County and municipalities like City of Miami to operate legally. Must be renewed annually

-

Industry-specific permits: Food establishments need health permits from the Florida Department of Health, retailers need sales tax permits from the Florida Department of Revenue.

2. Key Regulations for Bookkeeping and Financial Records

Maintaining accurate financial records is not only vital for business success but is also a legal requirement in Miami. Proper bookkeeping helps in preparing for tax season, securing funding, and monitoring your financial health. Here’s what you need to know:

Maintaining accurate financial records is not just smart—it’s the law in Florida:

-

Recordkeeping requirements: Businesses must keep receipts, invoices, bank statements, payroll records, and tax filings. See IRS guidelines

-

Tax compliance: Miami businesses must calculate and remit state sales tax, income tax, and applicable local taxes. Florida Dept. of Revenue

-

Digital record management: The State of Florida encourages digital storage of business documents using cloud-based solutions.

Our services use secure systems to help businesses manage and store financial records for audits and tax season.

3. Avoiding Common Compliance Pitfalls

To remain compliant and avoid penalties, businesses should be vigilant about common mistakes:

- Failing to Renew Licenses on Time: Deadlines for renewing licenses can vary. Missing these can result in fines or even the suspension of your business operations

- Inaccurate Financial Reporting: Incomplete or incorrect financial records can lead to compliance issues, especially during audits. Make sure all entries are current and accurate

- Mixing Personal and Business Finances: Keeping separate accounts for personal and business finances ensures clarity and reduces errors during bookkeeping

Schedule a free consultation today to know more.

4. Benefits of Professional Bookkeeping Services

Partnering with experts in bookkeeping can provide significant advantages:

- Accurate and Timely Financial Insights: Professional bookkeepers can deliver real-time financial data that help in strategic planning and budgeting.

- Stress-Free Tax Filing: They ensure your financial records are audit-ready, which simplifies tax season and reduces the risk of costly errors.

- Adaptation to Regulatory Changes: Bookkeeping professionals stay updated with Florida’s ever-evolving laws, ensuring your business remains compliant

Explore our Accounts Payable & Receivable services to see how we keep your operations running smoothly.

5. Steps to Start Preparing for Compliance

- Consult a Professional: Engage with an accountant or bookkeeper who understands Miami’s specific requirements. They can guide you through setting up a compliant bookkeeping system.

- Use Reliable Software: Implement accounting software tailored for Miami businesses that supports local tax calculations and financial reporting.

- Schedule Regular Audits: Routine internal checks can help identify discrepancies and ensure your records align with local and state requirements

What’s Next?

Navigating Miami’s regulatory landscape can seem complex, but proper licensing and diligent bookkeeping make it manageable.

By understanding the rules and investing in professional help, you can focus on growing your business confidently.

We offers tailored bookkeeping services that keep your business compliant and streamlined, helping you succeed in Miami’s vibrant market.

Contact us today for a free consultation and let’s build your financial success together