As businesses in Miami face increased calls for equity, accountability, and legal compliance, one trend is rising to the top: pay transparency.

While larger companies may already be under pressure to disclose salary bands and publish compensation policies, small businesses also stand to gain from clearer, more consistent compensation practices—especially when these practices are paired with robust bookkeeping Miami services.

Why? Because transparency isn’t just about talking numbers—it’s about tracking them, documenting them, and reporting them in ways that stand up to scrutiny.

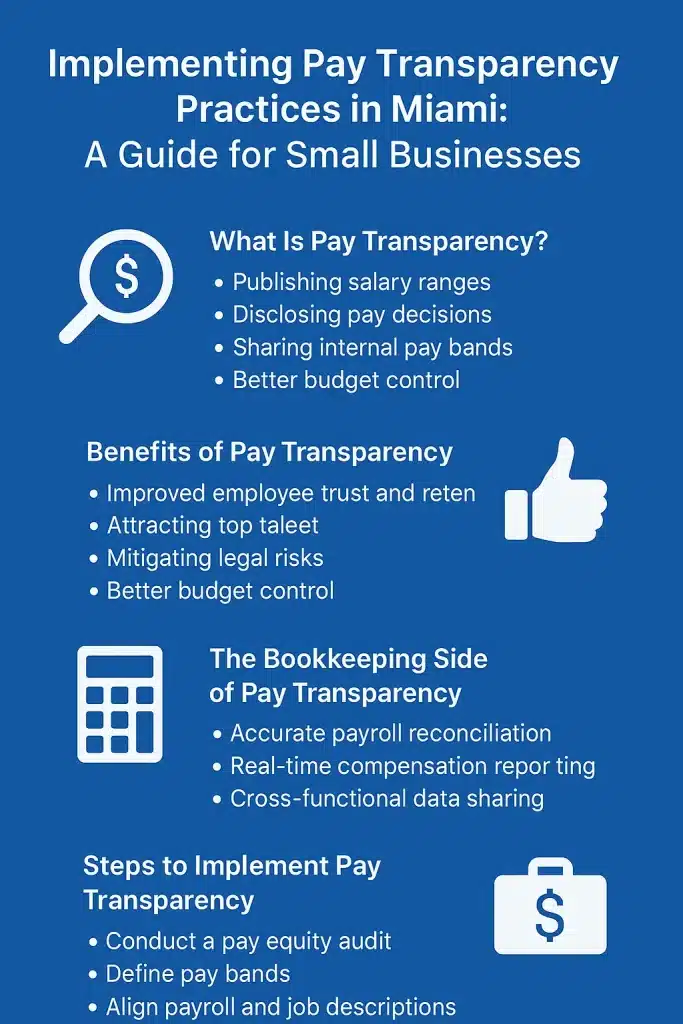

What Is Pay Transparency—and Why Does It Matter in Miami?

Pay transparency refers to the degree to which employers openly communicate about compensation structures.

This may include:

-

Publishing salary ranges on job postings

-

Informing employees about how raises and bonuses are determined

-

Disclosing company-wide wage equity metrics

-

Ensuring pay decisions are well-documented and free from bias

In Miami’s evolving labor market, transparency isn’t just a trend—it’s a trust-builder.

According to a 2023 report from Glassdoor, 63% of workers prefer to work at a company that discloses pay information, even if the salary is lower than average.

For small businesses looking to attract and retain talent, building a culture of clarity can become a competitive edge.

Why Miami Businesses Should Take Notice

Florida does not currently mandate pay transparency statewide, but employers in cities like Miami should be aware of:

-

Federal regulations such as the Equal Pay Act and Title VII, which prohibit pay discrimination.

-

EEOC guidance encouraging documentation of pay practices and proactive wage audits.

-

Anticipated local ordinances or state legislation that may mimic trends from other states (e.g., New York, California, Colorado).

More importantly, small businesses that lack clean payroll and wage reporting structures may unintentionally violate wage equity rules. That’s where bookkeeping becomes your first line of defense.

Learn more about how to stay compliant in our blog on Miami’s business licensing and bookkeeping regulations.

How Pay Transparency Affects Your Bookkeeping and Payroll

Implementing pay transparency is more than a policy—it’s a system. Here’s what small businesses in Miami should keep in mind:

1. Clear Payroll Categorization

You’ll need to define compensation types (base pay, bonuses, commissions, overtime) in a way that’s consistent across departments and easy to track.

Our accounts receivable and payable services in Miami are designed to ensure that all compensation entries are logged correctly and reviewed in real time.

2. Accurate Wage Documentation

When pay structures are shared internally or externally, accuracy is non-negotiable. Inconsistent numbers could lead to employee distrust—or worse, legal trouble.

Your bookkeeper should help validate wage tables, audit discrepancies, and reconcile payroll data with time tracking or performance systems.

3. Transparent Bonus and Raise Tracking

Many companies falter when explaining why one employee receives a bonus or raise and another doesn’t.

Documenting these decisions through integrated bookkeeping and HR systems reduces confusion and builds trust.

Practical Steps to Implement Pay Transparency

Step 1: Audit Current Compensation Structures

Work with your bookkeeper to evaluate current salary bands, discrepancies, and undocumented adjustments.

Spot inconsistencies before they become public issues.

Step 2: Create a Compensation Philosophy

Define how you determine pay—based on skills, experience, tenure, performance, or market data. Put this in writing and share it with your employees.

Step 3: Update Job Descriptions

Include pay ranges and relevant compensation details in all internal and external job postings. This not only complies with emerging best practices—it also saves time during hiring.

Step 4: Train Managers and Payroll Teams

Make sure everyone involved in hiring, compensation, and finance understands the transparency strategy and how to communicate it consistently.

Step 5: Automate Payroll Reporting

Ensure your payroll systems are integrated with your bookkeeping platform to produce clean, auditable reports for internal review and external compliance.

Need help avoiding financial missteps in this process? Check out our article on how bookkeeping services in Miami can help you avoid common financial mistakes.

Benefits of Pay Transparency for Small Businesses

-

Boost Employee Retention: Fairness fosters loyalty. Transparency can reduce turnover by clarifying how pay decisions are made.

-

Attract Top Talent: Applicants are more likely to trust businesses with open compensation practices.

-

Enhance Financial Accountability: When you document and justify pay decisions, your financials become more robust—and easier to defend.

-

Strengthen Brand Reputation: Companies that lead with fairness gain credibility with both customers and employees.

Common Mistakes to Avoid

Even well-intentioned transparency efforts can backfire. Avoid these pitfalls:

-

Disclosing inconsistent or outdated pay ranges

-

Failing to document bonus or raise criteria

-

Overpromising equity or performance-based rewards

-

Relying on manual spreadsheets instead of automated systems

These missteps often stem from weak financial infrastructure—which is where expert bookkeeping saves the day.

Don’t let costly mistakes slow your business down, book your free consultation today and get expert guidance tailored to your needs!

Bookkeeping Tools That Support Transparency

Profitline helps Miami small businesses implement transparency the right way by integrating financial reporting tools such as:

-

Cloud-based payroll platforms (like Gusto or QuickBooks Payroll)

-

Compensation dashboards

-

Automated ledger entries for bonuses and overtime

-

Secure document storage for wage policies and employee records

We don’t just handle your numbers—we help make them meaningful, accessible, and aligned with your company’s values.

Schedule Today

Pay transparency isn’t just a trend—it’s a strategic advantage. When done right, it builds trust, improves retention, and strengthens your company’s financial backbone.

But none of this works without the right systems in place. That’s where we come in.

With our professional bookkeeping services by your side, you can shift your focus back to building and bidding while we handle the financial details.

From payroll alignment to audit-proof reporting, we’re here to make your transition to transparency smooth, smart, and scalable.

Let’s build a stronger foundation for your contracting business—book a free consultation today and discover how expert bookkeeping can be your best competitive edge.