For contractors operating in South Florida, especially in the public sector, navigating Miami-Dade’s regulatory landscape requires more than just great project management.

It demands meticulous financial tracking and compliance—this is where professional bookkeeping Miami services come into play.

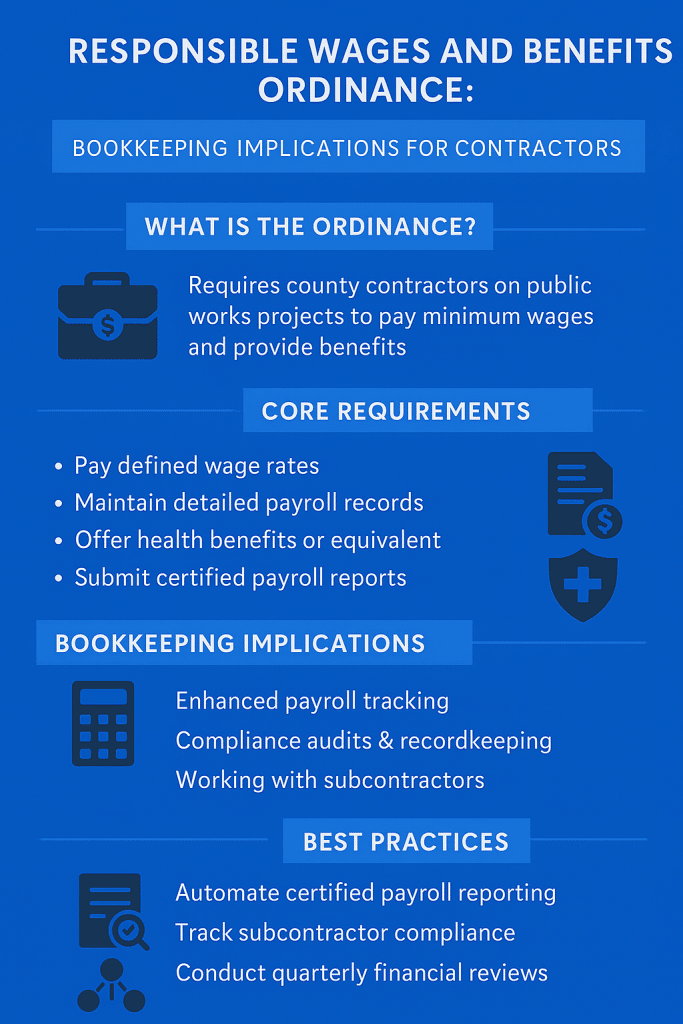

One major regulation affecting government contractors is the Responsible Wages and Benefits Ordinance (RWBO), a local mandate that ensures fair compensation and benefits on public works projects.

In this blog, we’ll break down what the RWBO entails, how it affects your bookkeeping and payroll processes, and how we can help you stay compliant, efficient, and audit-ready.

What Is the Responsible Wages and Benefits Ordinance?

Enacted by the Miami-Dade County Commission, the RWBO mandates that contractors and subcontractors working on County-funded public works projects pay employees a minimum “responsible wage” that is typically higher than the federal or state minimum wage.

This also includes providing specific benefits, such as health insurance or monetary equivalents.

According to the Miami-Dade County Code, the ordinance applies to contracts valued over $100,000 that are funded in whole or in part by County funds and involves construction-related services such as roads, bridges, buildings, and more.

Core Requirements of the Ordinance

Contractors subject to the RWBO must:

-

Pay workers a wage rate defined by the County for specific job classifications.

-

Provide either health benefits or a monetary equivalent.

-

Maintain detailed and accessible payroll records.

-

Submit regular certified payroll reports.

-

Comply with additional equity and nondiscrimination clauses.

These requirements are strictly enforced and subject to audit. Failure to comply may result in penalties, disqualification from future contracts, or litigation.

Trust our team in Miami to help you be compliant and keep your bookkeeping to date.

Bookkeeping Implications for Contractors

Now, let’s get into the heart of the matter: what does this ordinance mean for your bookkeeping and financial reporting?

1. Enhanced Payroll Tracking

You must ensure that wages are tracked precisely for each employee, by job classification, and for every hour worked on a covered project.

A bookkeeping system that can integrate with payroll software is essential to calculate wage differentials and keep records consistent and verifiable.

We employ a diverse array of bookkeeping and accounting software, including trusted names like QuickBooks, Xero, and TaxJar, along with innovative platforms such as FreshBooks, Zoho Books, and Wave.

2. Certified Payroll Reporting

RWBO mandates the submission of certified payroll reports, typically on a weekly basis. These reports need to be formatted correctly and must include details such as:

-

Worker classification

-

Hours worked

-

Wages paid

-

Deductions

-

Fringe benefits

Professional bookkeeping services can help ensure that these reports are accurate, timely, and audit-proof.

3. Compliance Audits & Recordkeeping

Miami-Dade County conducts regular audits to ensure ordinance compliance. Contractors must retain wage and payroll records for a minimum of three years.

Improper documentation or inconsistent data can lead to red flags during an audit. We provide contractors with transparent and organized financial systems that make audit preparation stress-free.

Why RWBO Compliance Can Be Challenging Without the Right Help

Many small- to medium-sized contractors underestimate the administrative load of complying with RWBO.

Beyond labor costs, the indirect costs of compliance—staff time, software integration, data verification, and reporting—can be overwhelming. And yet, non-compliance is far costlier.

This is where experienced bookkeeping professionals make a tangible difference.

As outlined in our related article, “Staying Compliant with Miami’s Business Licensing and Bookkeeping Regulations,” local regulations are complex and often interwoven. The right financial partner helps you stay ahead of every deadline and audit.

Bookkeeping Best Practices for RWBO Compliance

Here are a few practical recommendations for contractors working under RWBO:

-

Use project-specific cost centers to track labor costs separately.

-

Automate certified payroll reporting to eliminate manual errors.

-

Cross-check wage classifications monthly to reflect any County updates.

-

Maintain fringe benefit logs—especially when offering cash equivalents.

-

Schedule quarterly financial reviews with your bookkeeper or accounting team.

Common Mistakes Contractors Make (and How to Avoid Them)

Many contractors fall into the trap of:

-

Underpaying fringe benefit equivalencies.

-

Submitting payroll reports with misclassified workers.

-

Losing track of subcontractor compliance.

In our article, “How Bookkeeping Services in Miami Can Help You Avoid Common Financial Mistakes,” we highlight real-world examples of how poor bookkeeping creates major compliance risks.

Our tailored services for Miami contractors, ensuring that all financial documentation, including RWBO-required materials, is managed with precision.

Working With Subcontractors: Extra Bookkeeping Caution

RWBO also requires contractors to ensure that all subcontractors comply with the ordinance. This means your bookkeeping system must include:

-

Tracking subcontractor certifications

-

Verifying their certified payroll reports

-

Auditing payments made to subcontractors

Failure on their part becomes your liability—so it’s vital to integrate subcontractor oversight into your financial workflows.

What’s Next?

In a highly regulated environment like Miami-Dade County, staying compliant with ordinances like RWBO isn’t optional—it’s essential.

But that doesn’t mean it has to be overwhelming. With our professional bookkeeping services by your side, you can shift your focus back to building and bidding while we handle the financial details.

Ready to turn compliance into confidence?

Let’s build a stronger foundation for your contracting business—book a free consultation today and discover how expert bookkeeping can be your best competitive edge.