In a fast-moving market like Houston—home to thriving industries such as energy, healthcare, logistics, and tech—your business success hinges on your people.

But recruiting talent is only half the battle. How you onboard new hires plays a crucial role in productivity, retention, and compliance.

For businesses navigating hybrid or remote operations, the onboarding experience must be seamless and strategic. And for companies focused on operational precision, bookkeeping Houston services must also be part of the equation.

From payroll setup to benefits tracking, onboarding touches multiple financial systems—making the link between HR and bookkeeping essential to long-term success. Trust us for the job.

Streamlined Onboarding

Faster Time-to-Productivity

When onboarding is disorganized, new hires feel confused and disengaged. A structured process ensures they get the tools, knowledge, and confidence needed to contribute quickly.

Improved Retention and Employee Satisfaction

According to SHRM, organizations with a formal onboarding process experience 50% greater new-hire retention and 62% greater productivity within the first year.

Legal and Payroll Compliance

Failing to collect proper documentation or mishandling wage setup during onboarding can lead to costly errors or audits.

A bookkeeping partner that integrates with HR processes can help avoid these risks.

Key Components of an Effective Onboarding Process

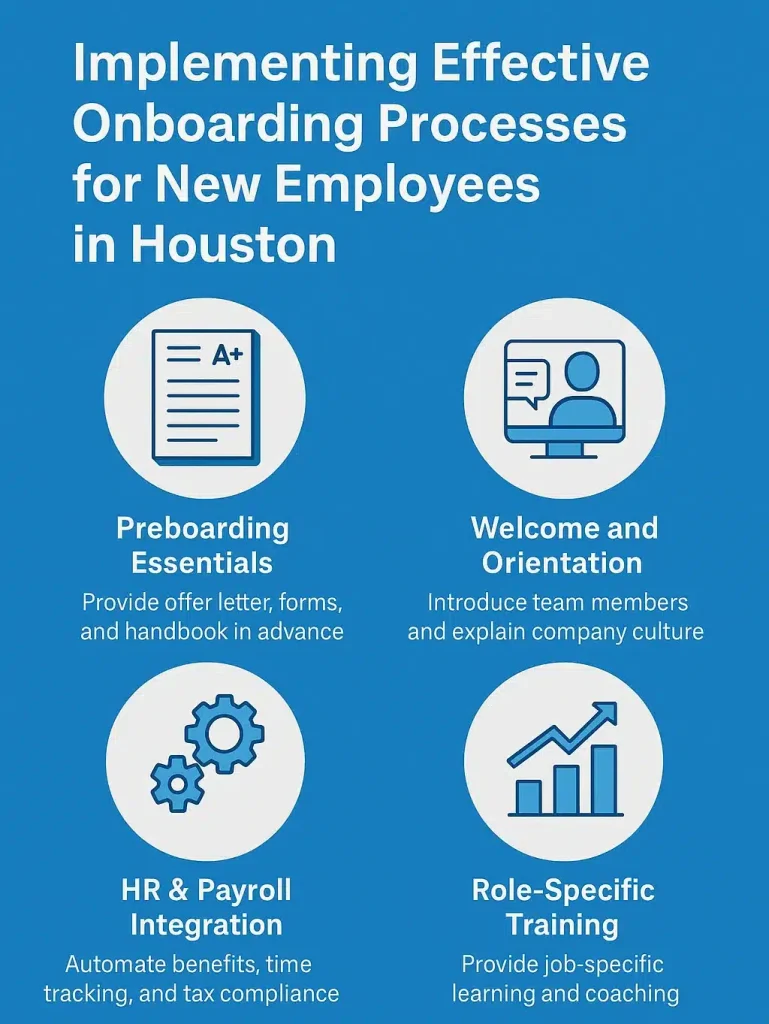

1. Preboarding Essentials

Start onboarding before day one. Send out:

-

Offer letter and job description

-

Benefits overview

-

Direct deposit and tax forms (W-4, I-9)

-

Company handbook and policies

We make sure the bookkeeping team has visibility on financial details like compensation, payment frequency, and deductions, so payroll and financial records are correctly aligned from the start.

2. Welcome and Orientation

Whether virtual or in-office, the first day should be welcoming and informative:

-

Introduce key team members

-

Provide a tour (virtual or physical)

-

Review mission, values, and culture

-

Clarify first-week expectations

At this stage, bookkeeping and HR integration ensures new hire data flows into payroll systems accurately—avoiding missed payments or incorrect withholdings.

3. HR & Payroll System Integration

Manual onboarding is error-prone and time-consuming. Instead, use systems that:

-

Automate benefits enrollment

-

Sync timesheets with payroll

-

Track paid time off and sick leave

-

Handle state and federal tax compliance

If you’re unsure where to start, our blog on selecting the right payroll software for your Houston business explores tools that combine onboarding, payroll, and bookkeeping into one platform.

4. Role-Specific Training Plans

Training should align with job duties and company goals. Incorporate:

-

Learning platforms (e.g., Lessonly, Trainual)

-

One-on-one coaching

-

Compliance training (OSHA, HIPAA, etc.)

Document training milestones, especially those related to compliance or licenses.

Our bookkeeping team in Houston can help track these expenses and associate them with training ROI or reimbursement tax credits.

5. Setting Clear Financial Expectations

From reimbursements to payroll schedules, onboarding is the right moment to clarify all financial aspects of employment:

-

How and when employees get paid

-

Reimbursement policies and how to submit expenses

-

Retirement and health contribution structures

-

Bonus eligibility and performance metrics

Aligning these financial touchpoints with your bookkeeping provider ensures that every element of compensation is recorded accurately, supporting payroll audits and long-term budgeting.

Remote and Hybrid Onboarding: Houston-Specific Tips

Leverage Local Tech Hubs and Networks

Houston’s robust business ecosystem includes tech accelerators and HR support networks like the Greater Houston Partnership and HR Houston.

These resources can supplement onboarding with webinars, compliance updates, and mentorship connections.

Prepare for Regional Disruptions

From hurricanes to power outages, Houston businesses must plan for onboarding interruptions.

Ensure all onboarding content and systems are accessible remotely so that operations aren’t disrupted by weather or infrastructure issues.

Stay Local, Think Global

As remote work widens your talent pool beyond Texas, onboarding must accommodate diverse tax jurisdictions, benefits requirements, and communication styles.

But your bookkeeping base must still ensure consistent financial documentation and payroll accuracy regardless of employee location. Reach out for a free consultation with us and get to know us!

Integrating HR and Bookkeeping for Onboarding Success

Onboarding doesn’t happen in a vacuum. It touches multiple systems and departments—including HR, IT, and accounting. When these departments work in silos, errors occur.

But when you integrate HR functions with bookkeeping, the benefits include:

-

Accurate wage and benefits setup

-

Real-time expense and reimbursement tracking

-

Automated tax withholding and reporting

-

Clean audit trails for every new hire

If you haven’t already, check out our blog on integrating HR and bookkeeping for operational efficiency to see how unifying these functions simplifies onboarding and beyond.

Common Mistakes to Avoid

-

Neglecting Payroll Enrollment: Failing to add employees to the payroll system on time can delay payments and damage morale.

-

Overloading New Hires: A day-one dump of policies and procedures is overwhelming. Space onboarding steps out.

-

Lack of Follow-up: Schedule check-ins at 30, 60, and 90 days to collect feedback and adjust as needed.

-

Ignoring Financial Orientation: Many employers forget to explain payroll schedules, taxes, or reimbursement processes—leading to confusion later.

Onboarding Metrics Worth Tracking

To improve your process over time, track metrics such as:

-

Time-to-productivity

-

Retention rate of new hires after 6 months

-

New hire satisfaction scores

-

Onboarding error rates (missed payroll, incorrect tax setup)

-

Cost per hire (including training and setup)

A professional bookkeeping partner can provide reports and insights based on these numbers, helping refine your onboarding ROI and compliance profile.

What’s Next?

In today’s fast-paced Houston market, onboarding is your first real chance to show new hires they’ve made the right choice—and to make sure your business runs like a well-oiled machine from day one.

The secret? Pairing a strong onboarding experience with airtight bookkeeping.

When HR and financial systems speak the same language, everything clicks: payroll’s flawless, compliance is covered, and your team hits the ground running.

Let’s create an onboarding process that’s not just smooth—it’s smart, scalable, and built for growth.

Curious how it all works?

Let’s talk it through—book a free consultation today and see how we can turn onboarding into one of your biggest business advantages.